Real Estate Tax Reduction Services

As of the 1st Quarter 2023, cost of capital increased fastest pace in the last 40 years. Increasing interest rates can have a negative impact on property values. Data from Costar suggests U.S. Composite index shows larger property has dropped 16% since last spring; fastest decline since 2008.

When interest rates increase, borrowing money to purchase property becomes more expensive, which can reduce demand for real estate; assuming demand remains unchanged. This can lead to a decrease in property values if there are fewer buyers in the market.

It is also worth noting that the relationship between interest rates and property values is complex and influenced by a variety of factors, we can provide more detailed information related to market data as well as other factors may impact the value of your property.

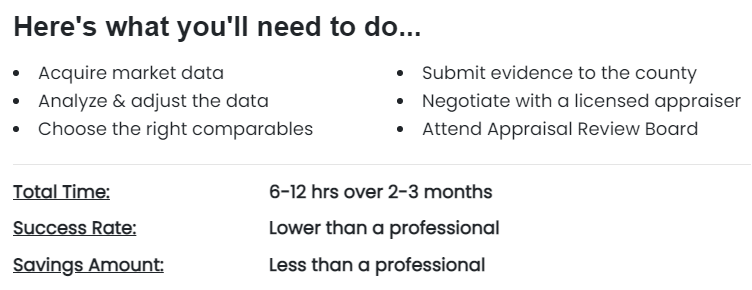

If you are considering a tax appeal, consider our services in pursuing a tax appeal to reduce your tax burden.